FDUSD vs APT: Comparing Stablecoin Performance in Volatile Markets

Introduction: FDUSD vs APT Investment Comparison

In the cryptocurrency market, the comparison between FDUSD vs APT has always been an unavoidable topic for investors. The two not only differ significantly in market cap ranking, application scenarios, and price performance, but also represent different positioning in crypto assets.

First Digital USD (FDUSD): Since its launch in 2023, it has gained market recognition for its efficiency in cross-border transactions.

Aptos (APT): Introduced in 2022, it has been hailed as a high-performance Layer 1 blockchain, and is one of the cryptocurrencies with significant global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between FDUSD vs APT, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

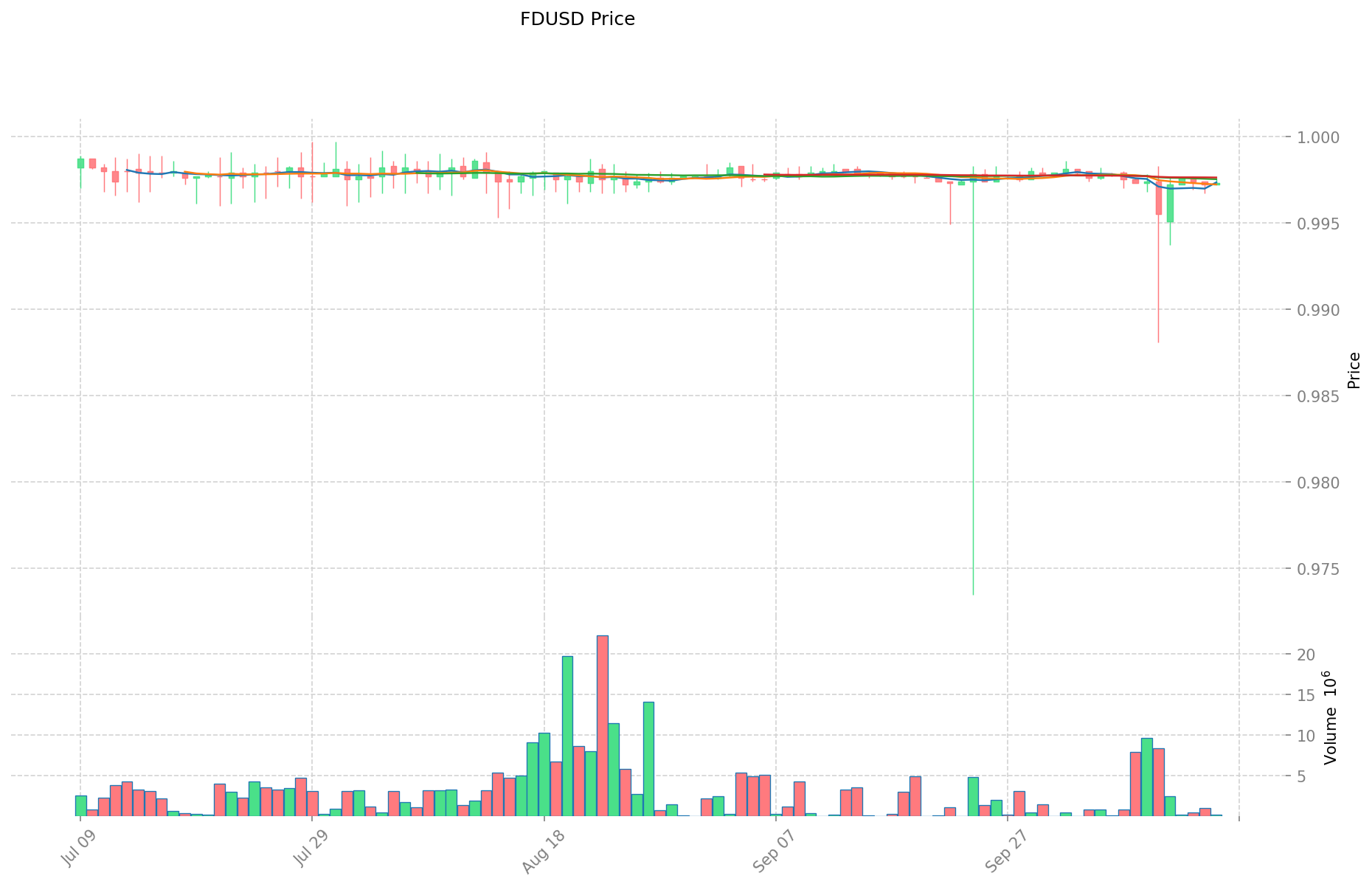

I. Price History Comparison and Current Market Status

FDUSD and APT Historical Price Trends

- 2024: FDUSD maintained stability due to its stablecoin nature, with price fluctuations within a narrow range.

- 2024: APT experienced significant volatility, reaching an all-time high of $19.92 on January 26, 2023, before declining.

- Comparative analysis: During market cycles, FDUSD remained relatively stable around $1, while APT showed higher volatility, dropping from its peak to a low of $2.8.

Current Market Situation (2025-10-16)

- FDUSD current price: $0.9973

- APT current price: $3.519

- 24-hour trading volume: FDUSD $217,902,910 vs APT $1,450,075,400

- Market Sentiment Index (Fear & Greed Index): 34 (Fear)

Click to view real-time prices:

- View FDUSD current price Market Price

- View APT current price Market Price

II. Core Factors Affecting FDUSD vs APT Investment Value

Supply Mechanism Comparison (Tokenomics)

- FDUSD: Fully collateralized stablecoin with 1:1 USD backing, requiring extensive adoption to form network effects

- APT: Limited supply with controlled distribution through ecosystem development

Institutional Adoption and Market Applications

- Institutional Holdings: Limited information on institutional preference between the two assets

- Enterprise Adoption: FDUSD faces challenges in widespread adoption as a stablecoin, requiring broader support and integration

- Regulatory Attitudes: Regulatory support varies across regions, with stable regulatory framework being crucial for both assets' long-term viability

Technical Development and Ecosystem Building

- FDUSD Technical Features: Zero-fee transactions introduced to increase competitiveness, though network effects remain critical

- APT Technical Development: Focus on blockchain infrastructure capabilities

- Ecosystem Comparison: Both require strong partnerships and integration with existing financial systems to gain market traction

Macroeconomic Factors and Market Cycles

- Inflation Environment Performance: FDUSD designed to maintain stable value against USD, potentially serving as hedge against currency volatility in emerging markets

- Monetary Policy Impact: Central bank policies affecting dollar strength directly impact FDUSD stability

- Geopolitical Factors: Global financial system integration and support from major financial players critical for adoption

III. 2025-2030 Price Prediction: FDUSD vs APT

Short-term Prediction (2025)

- FDUSD: Conservative $0.88-$1.00 | Optimistic $1.00-$1.41

- APT: Conservative $3.17-$3.52 | Optimistic $3.52-$3.73

Mid-term Prediction (2027)

- FDUSD may enter a growth phase, with prices expected between $1.25-$1.45

- APT may enter a consolidation phase, with prices expected between $3.75-$4.55

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- FDUSD: Base scenario $1.47-$1.69 | Optimistic scenario $1.69-$1.81

- APT: Base scenario $5.17-$5.94 | Optimistic scenario $5.94-$7.84

Disclaimer

FDUSD:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.406193 | 0.9973 | 0.877624 | 0 |

| 2026 | 1.51420059 | 1.2017465 | 1.00946706 | 20 |

| 2027 | 1.45303169315 | 1.357973545 | 1.2493356614 | 36 |

| 2028 | 1.92553858813275 | 1.405502619075 | 0.74491638810975 | 40 |

| 2029 | 1.715486221711991 | 1.665520603603875 | 1.249140452702906 | 67 |

| 2030 | 1.808838651543988 | 1.690503412657933 | 1.470737969012401 | 69 |

APT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 3.73226 | 3.521 | 3.1689 | 0 |

| 2026 | 4.714619 | 3.62663 | 2.538641 | 3 |

| 2027 | 4.545980705 | 4.1706245 | 3.75356205 | 18 |

| 2028 | 5.883708513375 | 4.3583026025 | 3.6609741861 | 23 |

| 2029 | 6.7597273364775 | 5.1210055579375 | 3.533493834976875 | 45 |

| 2030 | 7.8412837103139 | 5.9403664472075 | 5.168118809070525 | 68 |

IV. Investment Strategy Comparison: FDUSD vs APT

Long-term vs Short-term Investment Strategies

- FDUSD: Suitable for investors focused on stability and potential payment solutions

- APT: Suitable for investors interested in blockchain ecosystem potential and higher risk-reward

Risk Management and Asset Allocation

- Conservative investors: FDUSD: 70% vs APT: 30%

- Aggressive investors: FDUSD: 40% vs APT: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- FDUSD: Limited adoption risk, competition from other stablecoins

- APT: Higher volatility, susceptible to market sentiment shifts

Technical Risk

- FDUSD: Scalability, network stability

- APT: Network congestion, smart contract vulnerabilities

Regulatory Risk

- Global regulatory policies may impact both assets differently, with stablecoins like FDUSD potentially facing stricter oversight

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- FDUSD advantages: Stability, potential for payment solutions, hedge against volatility

- APT advantages: High-performance blockchain, ecosystem growth potential

✅ Investment Advice:

- New investors: Consider a higher allocation to FDUSD for stability

- Experienced investors: Balanced approach with both assets based on risk tolerance

- Institutional investors: Evaluate FDUSD for treasury management, APT for blockchain technology exposure

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the key differences between FDUSD and APT? A: FDUSD is a stablecoin pegged to the US dollar, offering price stability and potential for payment solutions. APT is a high-performance Layer 1 blockchain token with higher volatility and potential for ecosystem growth.

Q2: Which asset is better for long-term investment? A: The choice depends on individual investment goals. FDUSD is better for stability and as a hedge against volatility, while APT offers higher potential returns with increased risk due to its blockchain ecosystem development.

Q3: How do the supply mechanisms of FDUSD and APT differ? A: FDUSD is fully collateralized with a 1:1 USD backing, while APT has a limited supply with controlled distribution through ecosystem development.

Q4: What are the main risks associated with investing in FDUSD and APT? A: FDUSD faces adoption and competition risks from other stablecoins. APT is subject to higher market volatility and potential technical risks such as network congestion and smart contract vulnerabilities.

Q5: How might regulatory changes affect FDUSD and APT? A: Regulatory changes could impact both assets, with FDUSD potentially facing stricter oversight as a stablecoin. APT may be affected by broader cryptocurrency regulations.

Q6: What are the price predictions for FDUSD and APT by 2030? A: According to the provided predictions, FDUSD is expected to reach $1.47-$1.81, while APT is projected to reach $5.17-$7.84 by 2030. However, these predictions are speculative and subject to market conditions.

Q7: How should investors allocate their portfolio between FDUSD and APT? A: Conservative investors might consider allocating 70% to FDUSD and 30% to APT, while aggressive investors might opt for 40% FDUSD and 60% APT. The exact allocation should be based on individual risk tolerance and investment goals.

2025 XPL Price Prediction: Analyzing Market Trends and Potential Growth Factors

What is the Current Market Overview for XPL Cryptocurrency in 2025?

PYUSD vs ZIL: Comparing Stablecoins and Blockchain Platforms for Digital Payments

USDP vs ZIL: Comparing Stablecoin Performance in Volatile Markets

Is MeterStable (MTR) a good investment?: Analyzing the Potential and Risks of this Stablecoin in the Crypto Market

RSR vs LTC: Comparing Risk-Sharing Reserves and Long-Term Care Insurance for Retirement Planning

Understanding Polkadot (DOT): A Guide to Blockchain Interoperability

2025 REEF Price Prediction: Expert Analysis and Market Outlook for the Year Ahead

2025 ZCX Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 FLM Price Prediction: Expert Analysis and Market Forecast for Flamingo Token

2025 SOV Price Prediction: Expert Analysis and Market Forecast for the Coming Year