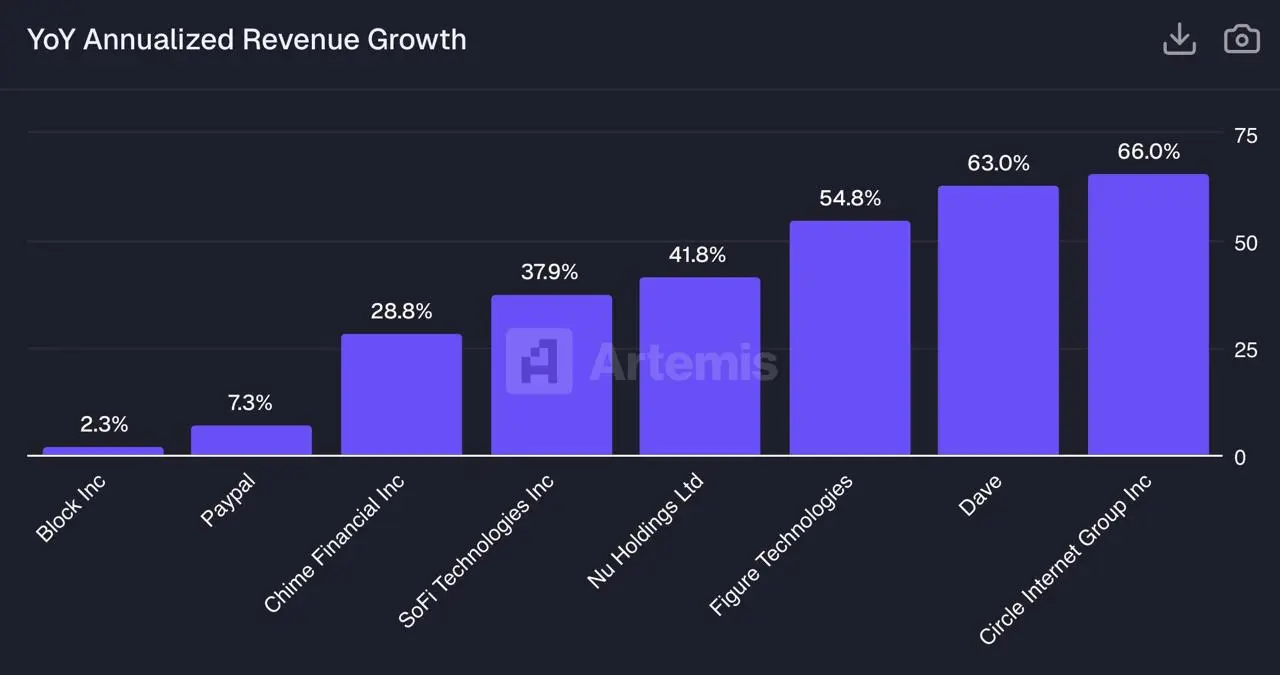

USDC, possibly the Trojan horse through which the US exports "digital hegemony."

Yesterday, I did something very interesting:

I had Gemini engage in long-short opposing debates around #CRCL (#Circle ), continuously rebutting, questioning, and deepening the discussion.

Not just one round,

but over a dozen rounds.

The conclusion is very clear:

The truth does not appear at the first layer.

1. An important methodological insight

1️⃣ Multi-round adversarial thinking can greatly improve cognitive quality.

Seeing the market as only bullish or bearish is basically self-brainwashing.

But when a viewpo

Yesterday, I did something very interesting:

I had Gemini engage in long-short opposing debates around #CRCL (#Circle ), continuously rebutting, questioning, and deepening the discussion.

Not just one round,

but over a dozen rounds.

The conclusion is very clear:

The truth does not appear at the first layer.

1. An important methodological insight

1️⃣ Multi-round adversarial thinking can greatly improve cognitive quality.

Seeing the market as only bullish or bearish is basically self-brainwashing.

But when a viewpo

View Original