Start of the Year January Outlook: Is the Christmas rally continuing into the new year?

In the first two trading days before New Year’s Day, the market performance was not good:

#美股 Slight pullback, BTC remains volatile, sentiment is cautious.

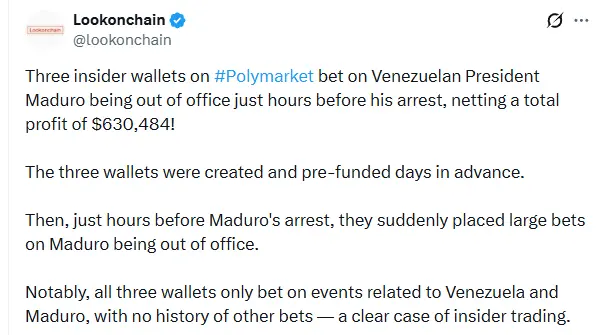

But last weekend’s swift action by the US against Venezuela clearly changed the market’s risk pricing.

As analyzed in yesterday’s tweet—

Quick decisive action and reducing uncertainty are positive for risk assets.

To put it simply, global funds’ confidence in “US assets” ultimately depends on national strength and execution capability.

This move also s

In the first two trading days before New Year’s Day, the market performance was not good:

#美股 Slight pullback, BTC remains volatile, sentiment is cautious.

But last weekend’s swift action by the US against Venezuela clearly changed the market’s risk pricing.

As analyzed in yesterday’s tweet—

Quick decisive action and reducing uncertainty are positive for risk assets.

To put it simply, global funds’ confidence in “US assets” ultimately depends on national strength and execution capability.

This move also s

BTC1,19%