CryptoFalcon2x

Cryptos, Blockchain, Exchanges, and HODL Strategies. Analysis and Predictions for #BTC and #ETH Charts.

Hot take: utility matters more than hype.

$TIME already has 60k+ users using it on MEEET for payments, staking, and rewards. Creators earn with it. Time of Heroes runs on it.

TGE just adds governance and more incentives.

Watch usage, not noise.

@timeuniverse_io

$TIME already has 60k+ users using it on MEEET for payments, staking, and rewards. Creators earn with it. Time of Heroes runs on it.

TGE just adds governance and more incentives.

Watch usage, not noise.

@timeuniverse_io

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

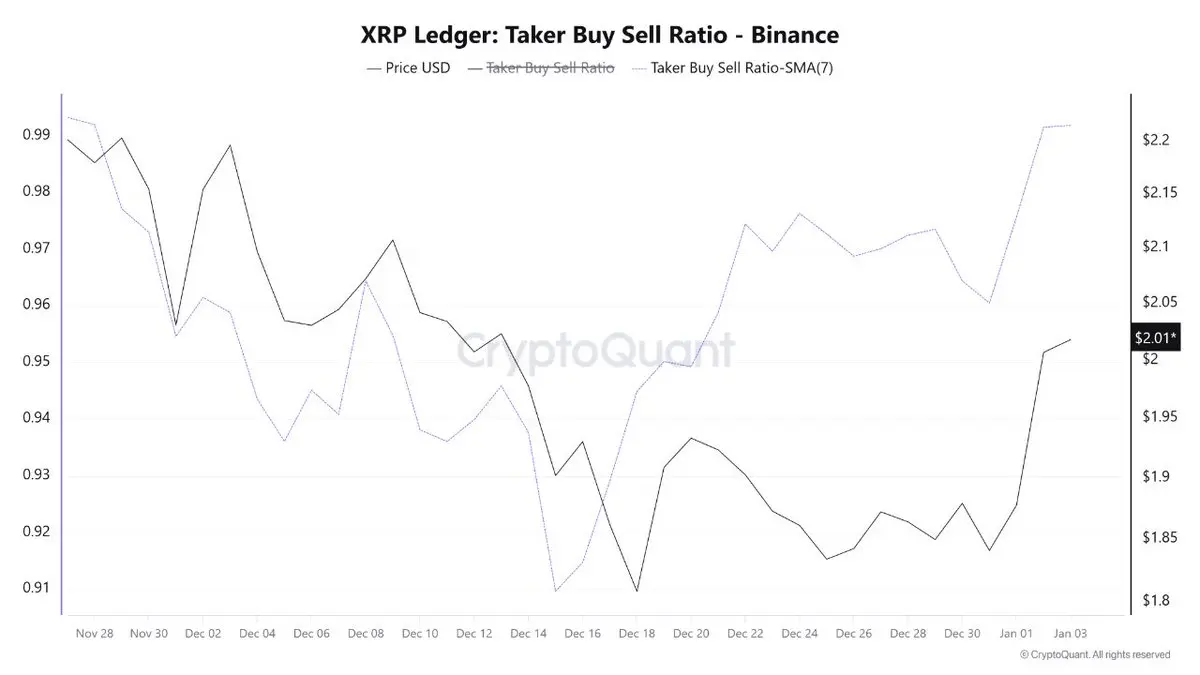

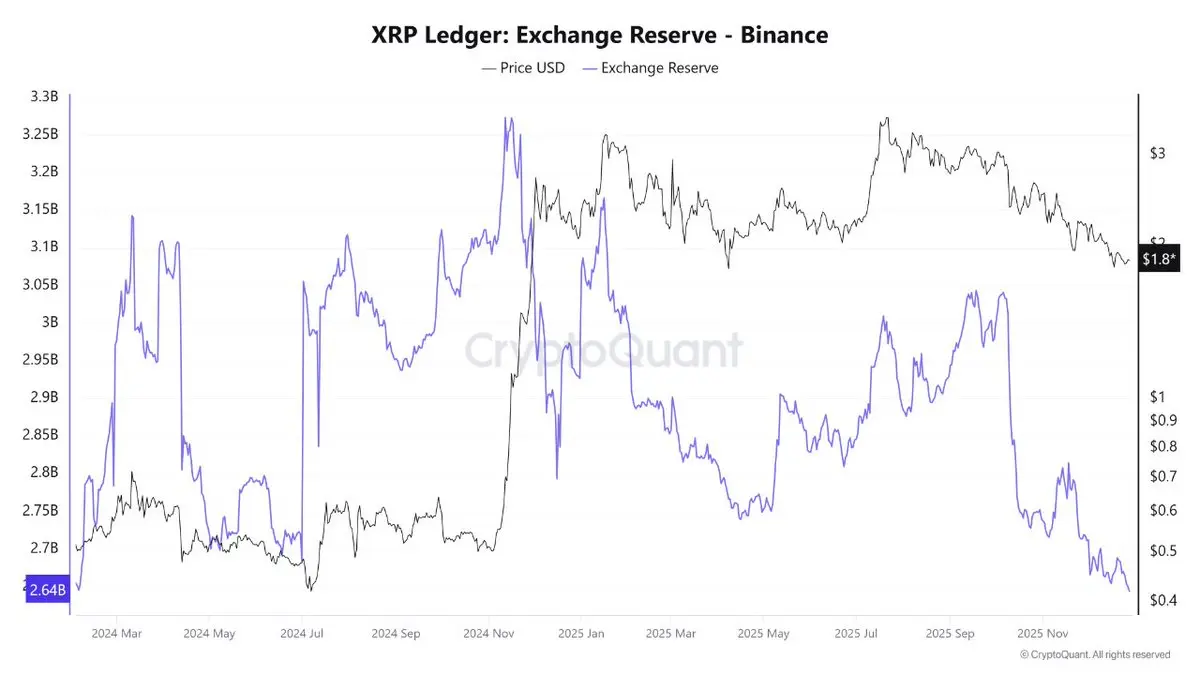

$XRP reserves just fell to ~2.64B : the lowest since 2024.

Price dropped to ~$1.80, but reserves didn’t rise. That matters.

This wasn’t heavy selling. It was weak demand.

Lower exchange supply = less sell pressure.

If buyers return, moves can get sharp.

Via @coinexcreators

Price dropped to ~$1.80, but reserves didn’t rise. That matters.

This wasn’t heavy selling. It was weak demand.

Lower exchange supply = less sell pressure.

If buyers return, moves can get sharp.

Via @coinexcreators

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

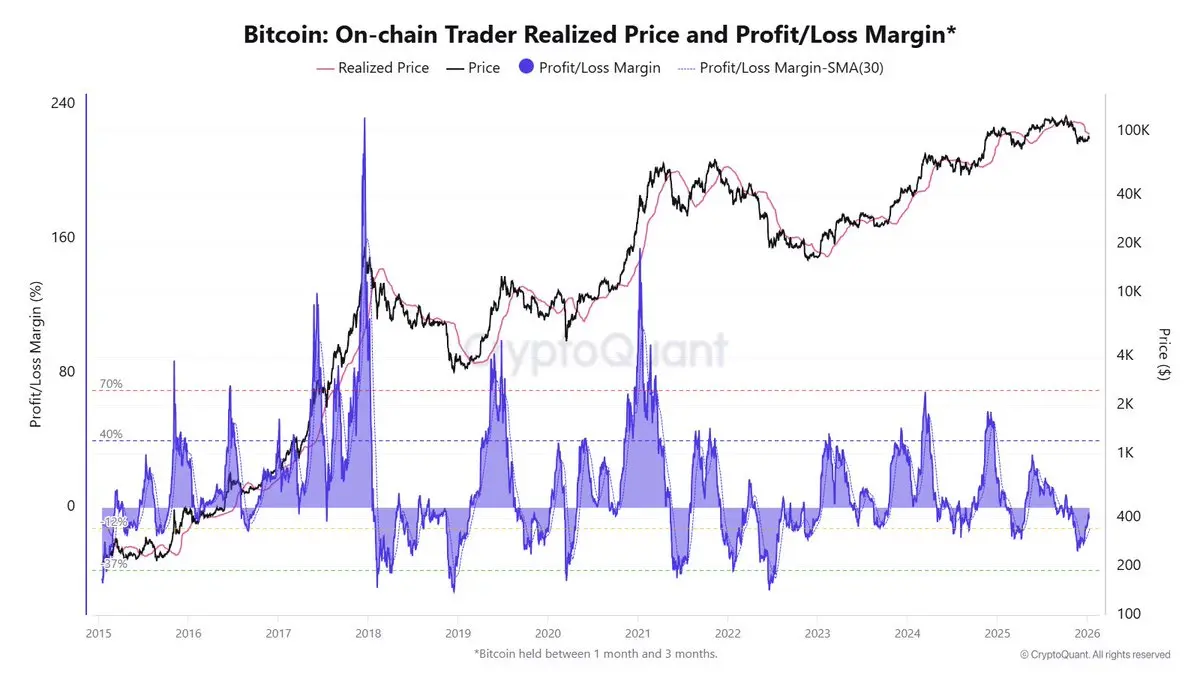

$BTC recent bounce isn’t backed by whales.

Futures data shows rising retail-sized orders while large players stay quiet. In past rallies, whales led. This time, they’re missing.

Retail-driven moves rarely hold → consolidation or downside risk remains.

Via @coinexcreators

Futures data shows rising retail-sized orders while large players stay quiet. In past rallies, whales led. This time, they’re missing.

Retail-driven moves rarely hold → consolidation or downside risk remains.

Via @coinexcreators

- Reward

- like

- Comment

- Repost

- Share

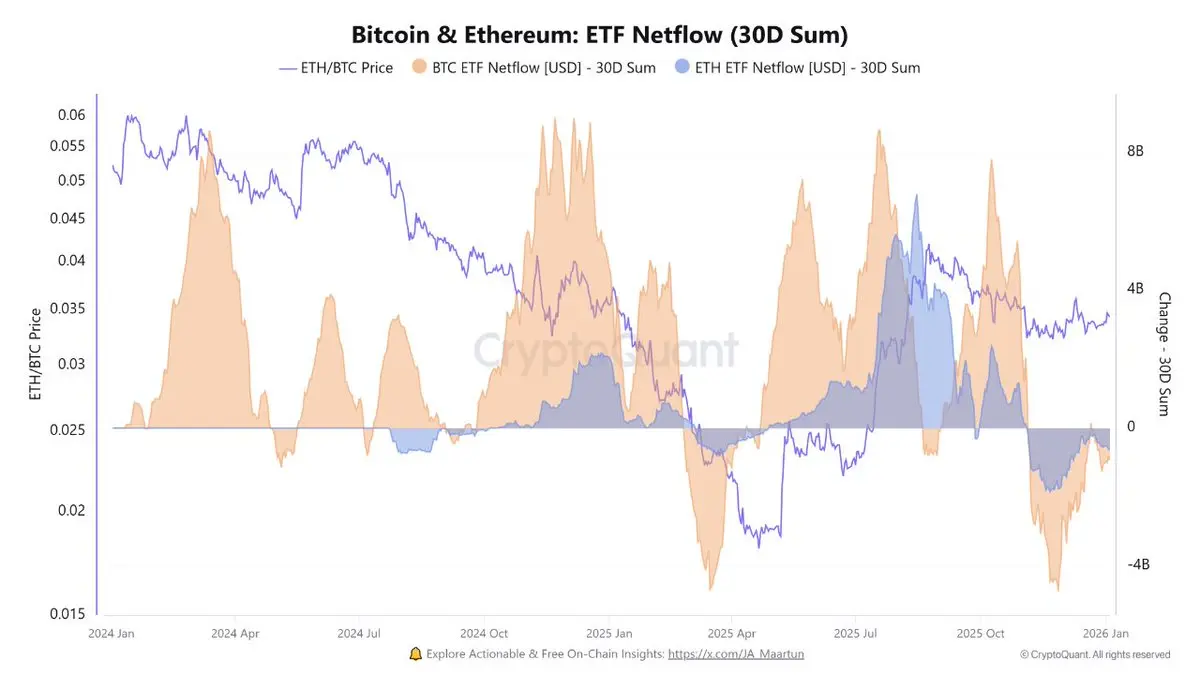

$BTC didn’t “diverge” from the S&P in H2 2025, it structurally decoupled.

ETF flows replaced risk-on trading. Leverage cooled. Macro liquidity skipped crypto. Short-term traders exited. Price discovery turned internal.

This is consolidation, not stress.

Via @coinexcreators

ETF flows replaced risk-on trading. Leverage cooled. Macro liquidity skipped crypto. Short-term traders exited. Price discovery turned internal.

This is consolidation, not stress.

Via @coinexcreators

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More23.56K Popularity

18.82K Popularity

30.45K Popularity

10.67K Popularity

9.6K Popularity

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889Gate 2025 Year-End Gala Square TOP50 List Announced!

The final ranking phase is now live.

Earn Votes by watching live streams and posting.

30 Votes = 1 chance — support your favorite creators now!

👉 https://www.gate.com/activities/community-vote-2025

iPhone 17 Pro Max, JD gift cards, Mi Band, Gate merch await you!

Creators are welcome to rally fans to climb the rankings and win rewards!

Voting ends: Jan 20, 02:00 UTC

Details: https://www.gate.com/announcements/article/48693