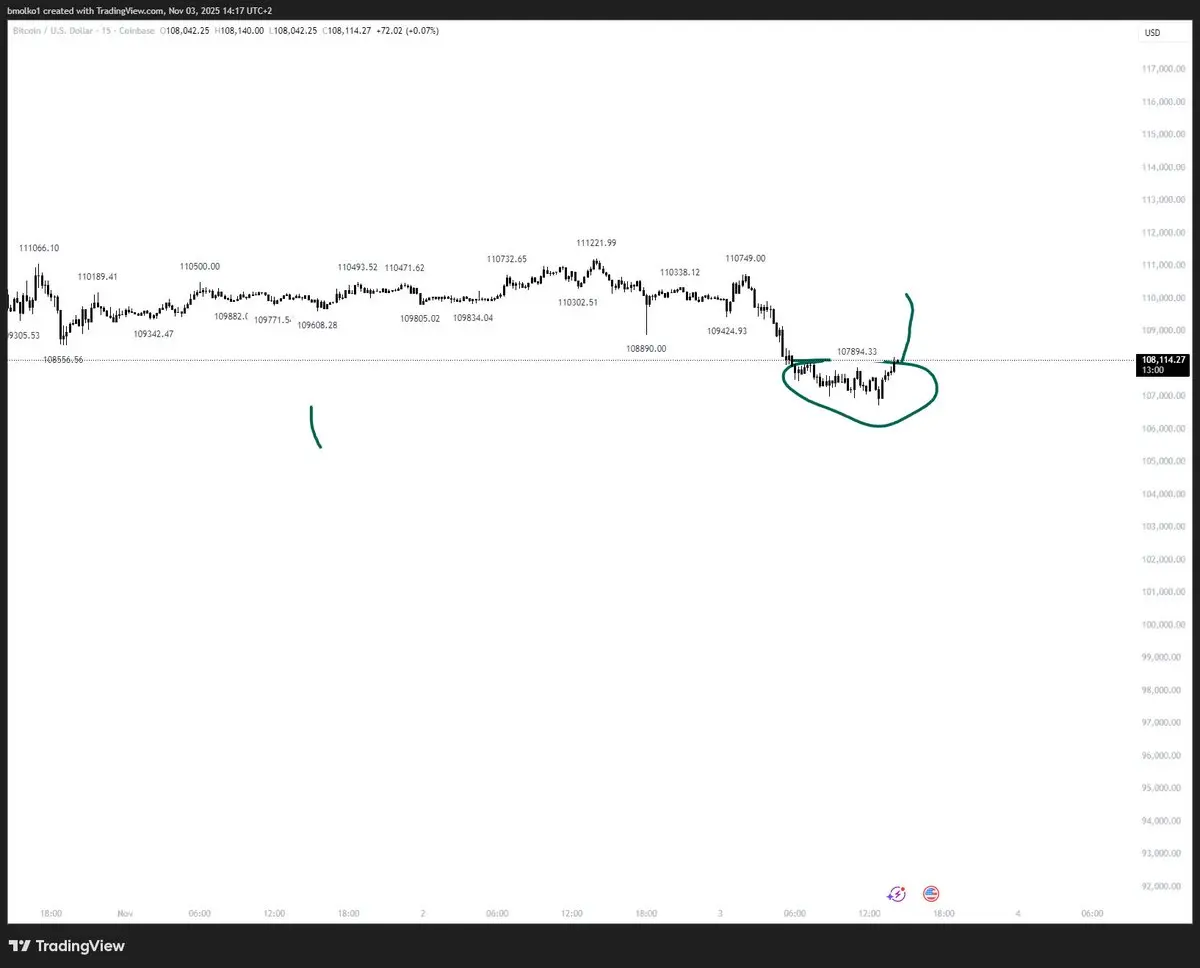

Strap in boys $BTC

📆 KEY MARKET EVENTS — OCT 27–31, 2025

⚠️ Volatility week ahead — Fed rate cut, mega-cap earnings, global CB decisions.

⸻

🔥 HIGH-IMPACT CATALYSTS

•🧨 FOMC (Wed, Oct 29 @ 2 PM ET)

→ Fed expected -25 bps to 3.75-4.00%.

→ Dovish Powell = risk-on / Hawkish tone = USD bid, tech fade.

•💻 MEGA-CAP TECH EARNINGS

→ Tue: Microsoft, Alphabet, Meta (after close)

→ Wed: Apple, Amazon (after close)

→ AI + cloud + consumer data = Nasdaq drivers.

•🇺🇸 Q3 GDP (Thu, 8:30 AM ET)

→ Exp. +2.8% QoQ (↓ from 3.8%) – key growth gauge pre-FOMC guidance.

•📉 PCE INFLATION (Friday 8:30 AM ET)

→ Co

📆 KEY MARKET EVENTS — OCT 27–31, 2025

⚠️ Volatility week ahead — Fed rate cut, mega-cap earnings, global CB decisions.

⸻

🔥 HIGH-IMPACT CATALYSTS

•🧨 FOMC (Wed, Oct 29 @ 2 PM ET)

→ Fed expected -25 bps to 3.75-4.00%.

→ Dovish Powell = risk-on / Hawkish tone = USD bid, tech fade.

•💻 MEGA-CAP TECH EARNINGS

→ Tue: Microsoft, Alphabet, Meta (after close)

→ Wed: Apple, Amazon (after close)

→ AI + cloud + consumer data = Nasdaq drivers.

•🇺🇸 Q3 GDP (Thu, 8:30 AM ET)

→ Exp. +2.8% QoQ (↓ from 3.8%) – key growth gauge pre-FOMC guidance.

•📉 PCE INFLATION (Friday 8:30 AM ET)

→ Co

BTC-1.24%